Shoppers have it nice. They can click right into product reviews from a variety of sources. It’s a powerful source of information. But it’s still difficult to quickly identify accurate and relevant reviews. How many do you need to read to get a fair understanding? The answer is: More than you have time for. But there is a faster, better way. Marketvoice.AI gives you a quick, clear, credible overview of online reviews. We gather product reviews by the thousands and run them through algorithms that track and quantify which are the most influential. Marketvoice.AI also breaks down reviews and uses the data to generate scores for public opinion on each important aspect of a product. It’s the wisdom of crowds, supercharged.

+Break down point-by-point features and aspects to

understand what the online universe thinks of each brand, product or

service

+Compare changes over time. When a product changes, how does the

commentary react? Are responses getting better or worse. How do they compare with other brands or

products?

+Cut through the weeds. Opinions vary widely and since online comments

are free, there are plenty that just don’t make any sense or veer far off topic. The Perception Analysis

and Rankings take you beyond that by delivering clean, statistically valid analysis

that brings forward only what’s important to the broadest majority.

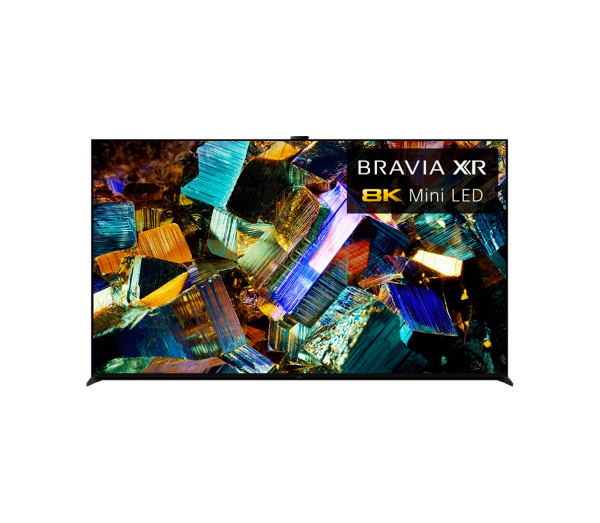

To demonstrate how MarketvoiceAI's Leaderboard works, we analyzed tens of

thousands of reviews and comments about high-end 4K televisions. We wanted to start with a product

that's common to households and where features are widely standardized and where quality is very

high across top brands. Here's what we found:

The data show picture

quality unsurprisingly remains the dominant determinant for TV buyers. It’s what consumers

are talking about the most when they discuss buying a TV. Price and streaming features were also very

important, rounding out the top three. We weight these aspects the heaviest to more precisely describe

consumer thinking.

But less heavily weighted aspects can also reveal how the market is

shifting among consumers. Interest in how well TVs work with apps is also significant. We know that

based on the amount of discussion devoted to the topic. For each aspect of televisions consumers talked

about, we collated a set of key words so that the links are clear and measurable between exactly what

consumers are saying and the total consensus view. For picture quality, for example, we identified words

including color, resolution, image, black, dim, lag and so on.

Most television buyers focus on the color, brightness and resolution the set produces. We tracked such conversations and identified more than 60 key words denoting this aspect, including resolution, pixels, black, graphic, 4K UHD, 120hz, color and brightness. All of the highest scoring TV brands also ranked very highly in terms of picture quality. It makes perfect sense that consumers would focus here. It's one area in which TVs have improved continuously and are likely to continue to develop. But which particular brands are winning reputations for picture quality is changing and may yield some surprises.

The data show consumers don’t necessarily believe the old saying that you always get what you pay for. They’re discussing price, which we define as value for money, very frequently. This suggests they’re interested in making sure they’re not overpaying. This is especially important to understand in the high-end TV market, where a significant percentage of shoppers and buyers are focused more on absolute quality than price performance. Even in this segment, consumers want to discuss value for money, meaning they understand that some brands and sets will offer better value for money than others.

Both of these aspects weighed in just below price and picture quality, showing they’re the key secondary considerations for shoppers and buyers. Audio quality scores for brands tended to track closely with those for picture quality and price, adding momentum to the top brands. Connectivity also popped up as a common topic that includes discussion of wifi, internet and buffering.

For a growing segment of TV users, watching television means streaming. Consumers are very interested in how a television handles streaming platforms, especially when the way content is being distributed is changing so fast. No one wants to buy a set that will require special equipment just to tap into the vastuniverse of films, shows and live events being sent across online networks. Settings and Controls also got a 12-point weighting, tied for the third-highest, because consumers are very interested in being able to simply, intuitively navigate across online, cable and broadcast networks and recorded content.

With the fourth-highest ranking, Sony’s overall score exactly matches the baseline consumer response at 39 points. While the mega-brand’s TVs lagged leaders in several key categories, they took the top spot in terms of connectivity, with a score of 30 points, compared with 27 for overall leader Toshiba, 22 for Insignia and 23 for HiSense. Sony also scored the second-highest for how it handles games at 40 points, lagging only LG at 47 points. Bottom line: Sony has long pursued the strategy of making its gear compatible from games to movies to music. This remains a key buying point, though the consumer perception is that you may not be getting the best value for money among brands.

Here’s a brand that’s earned a very high ranking given its reputation for low price relative to bigger brands. To be sure, the overall score of 41 points was well below the No. 1 brand, but its results for audio quality matched the leader's and the consumer response to its performance with games actually ranked higher than Toshiba’s. Among consumers that commented on the brand’s customer service, HiSense ranked above all othersat 29 points, compared with 20 for Toshiba and 19 for Insignia. Bottom line: If you favor music and sound and have no plans to enhance audio with add ons, HiSense is an excellent choice.

These TVs are made in China. but the brand is owned by the US-based Best Buy retail chain. It's an interesting surprise at the number-two spot for overall performance. While professional reviewers have often described the brand as a good value for the money, consumers are actually rating its performance very highly, independent of price. In the key picture quality category, Insignia ranked second behind only Toshiba and well ahead of better known global names like Sony, LG and Samsung. Insignia also came second in use of apps and first place in consumer response to the audio quality of its TVs. While mroe consumers mentioned Insignia's price compared with all other brands, Toshiba actually ranked slightly higher in terms of positive sentiment toward price, always a key factor. Bottom line: Insignia TVs compete very well with top brands on performance, regardless of price.

This legacy Japanese brand had the most positive ratings overall among the nine most commented-on brands offering high-end 4K televisions. The brand scored at the top for both picture quality and price, two of the three most heavily weighted aspects. On how well they work with apps, Toshiba sets scored 15 points above the baseline, compared with 7 points for the next highest-ranked brand. While Toshiba has seen some strong headwinds as an electronics conglomerate and in the TV market, consumers are signaling strong approval and demand for its best TVs. The rankings also show that how TVs use apps is a crucial differentiator for brands. Bottom line: If you find a Toshiba model that suits your specs, buy it with full confidence.